Monthly Economy & Travel Industry Summary: October 2024

The election, economics, and a calendar shift.

Economics, the Election, and the Path of Federal Reserve Rate Cuts

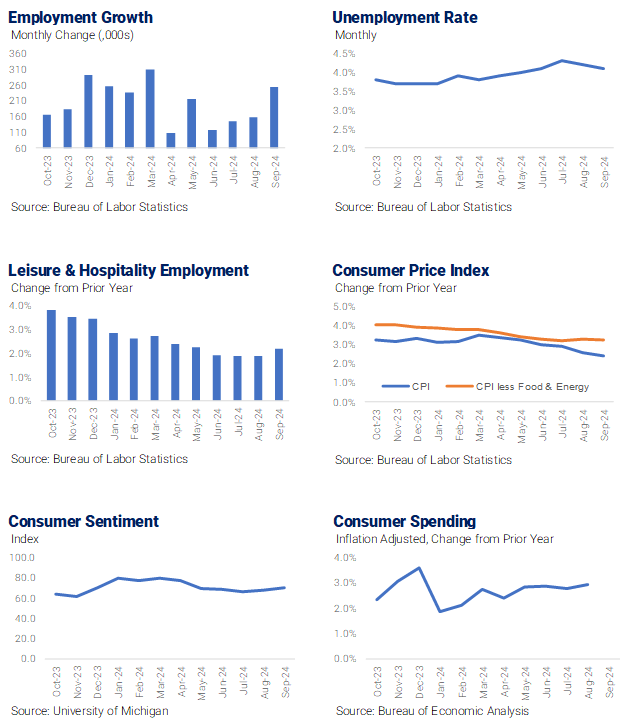

Recent conversations about the economy have largely centered around the Presidential election and the Federal Reserve’s likely course of action following the 50-basis point reduction in the Federal Funds rate in September.

Election polls in late October indicate the election is a toss-up but recent moves in U.S. long-term rates suggest a Trump victory is being priced in. Long-term interest rates trended higher over the past several weeks, with the 10-year Treasury yield up nearly 50bps since the Federal Reserve cut interest rates in September.

Some of the increase in long-term rates is attributed to the bond market betting on former President Donald Trump winning the election. A Trump administration is expected to pursue additional fiscal support via tax cuts and increased government spending, which will increase the deficit, pointing toward higher interest rates than in the baseline.

The rise in long-term rates suggests that if Trump wins the election, there may not be significant moves afterward, but long-term rates could drop if Harris is elected.

The bond market was also reacting to the recent increase in global oil prices and the risk of escalation in the Middle East. There is a strong correlation and causal relationship between global oil prices and market-based measures of inflation expectations, and the increase in inflation expectations accounted for roughly 12bps of the nearly 50bps rise in the 10-year Treasury yield.

Additionally, better-than-expected economic data since the September meeting of the Federal Open Market Committee (FOMC) also put upward pressure on the 10-year Treasury yield. Strong economic performance could lead the Fed to lower the federal funds rate more slowly than initially anticipated.

Numerous speeches by Fed officials in mid-October largely supported our forecast of a 25bp rate cut at the November meeting of the FOMC. For instance, San Francisco Fed President Mary Daly said that the incoming data hasn’t altered her view that the central bank needs to keep cutting interest rates to “guard” against weakening in the labor market. She argued that interest rates are restrictive for the economy and inflation is on a path to the Fed’s 2% target, warranting reductions in interest rates.

Another voting member, Cleveland Fed President Beth Hammack, cautioned that inflation is still running above the Fed’s 2% objective, but we interpret this as favoring a 25bp cut, rather than 50bps.

Dallas Fed President Lorie Logan, Kansas City Fed President Jeff Schmid, and Minneapolis Fed President Neel Kashkari all sung a similar tune in supporting a gradual reduction in the fed funds rate to reduce the restrictiveness of monetary policy.

Federal Reserve Chair Jerome Powell pays close attention to the Federal Reserve’s latest Beige Book, which collects reports of business conditions and activity from business contacts in the 12 Federal Reserve districts. The latest Beige Book showed economic activity was flat or grew modestly in nine of 12 Federal Reserve districts in the roughly seven weeks ended October 11, up from seven districts in the prior report.

Consumer spending was described as mixed, with some districts noting that consumers were shifting the composition of their spending toward less expensive alternatives. That’s consistent with our findings that the budgets of lower-income households have been increasingly squeezed by the costs of necessities, including housing, leaving less to spend on discretionary items. This has been evident in weak hotel demand among Economy and Midscale hotels, as discussed below.

Feedback from contacts in other sectors of the economy was mixed. Contacts in a number of districts said that investment plans in sectors such as manufacturing, real estate, and construction were on hold given the uncertainty about the outcome of the presidential election. However, firms were becoming more optimistic about the longer-term outlook, citing expectations for lower interest rates in 2025.

Members of the Federal Reserve’s Open Market Committee frequently reference the Fed’s mantra that the path of interest rates will be dependent on the data. Still, the central bank isn’t going to learn a lot about the labor market over the next few months. The incoming data on employment will be messy because of the temporary drag from strikes and a pair of hurricanes.

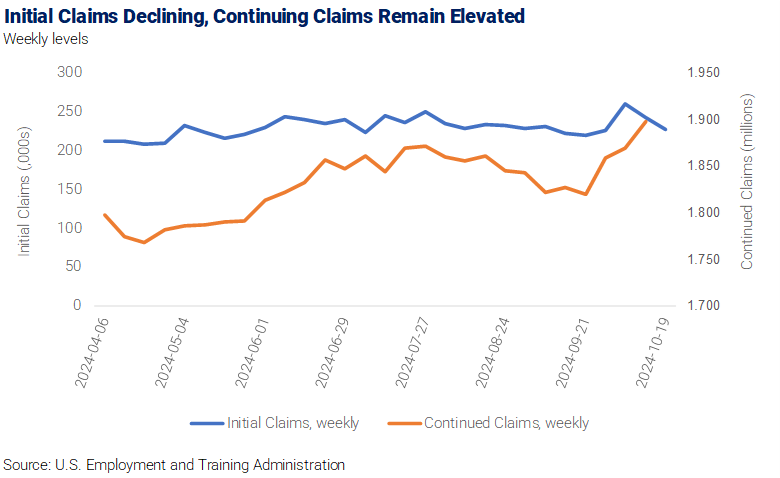

Initial jobless claims declined in the week ended October 19, as claims in some states impacted by Hurricane Helene continued to retreat from their recent highs. However, claims in Florida rose, likely as a result of Hurricane Milton. With the latest week’s decline, claims are in line with pre-hurricane levels and consistent with a labor market that continues to be characterized by few layoffs.

Continuing claims, the number of people who have already filed for unemployment benefits and continue to receive them, rose to their highest level since November 2021 in the week ended October 12. Workers impacted by the Boeing strike has boosted continued claims, those impacted by the hurricanes, and workers recently laid off by Stellantis, which boosted claims in Michigan and Ohio. The rise in continued claims points to a weak gain in payroll employment in October; we are also likely to see an uptick in the unemployment rate.

While initial claims return to pre-hurricane levels, continued claims may remain elevated longer. It may take time for all the workers impacted by the hurricanes to return to their jobs or find new employment, and some of the rise in claims reflects more permanent job losses, including workers laid off by Stellantis. We don’t think the Fed will be overly alarmed by these job losses, since economy-wide layoffs remain low. However, we believe risks to the labor market are sufficient to keep further rate cuts on track. Our baseline continues to assume 25bps rate cuts at each of the November and December FOMC meetings.

Calendar Shifts Constrain Hotel Performance in September

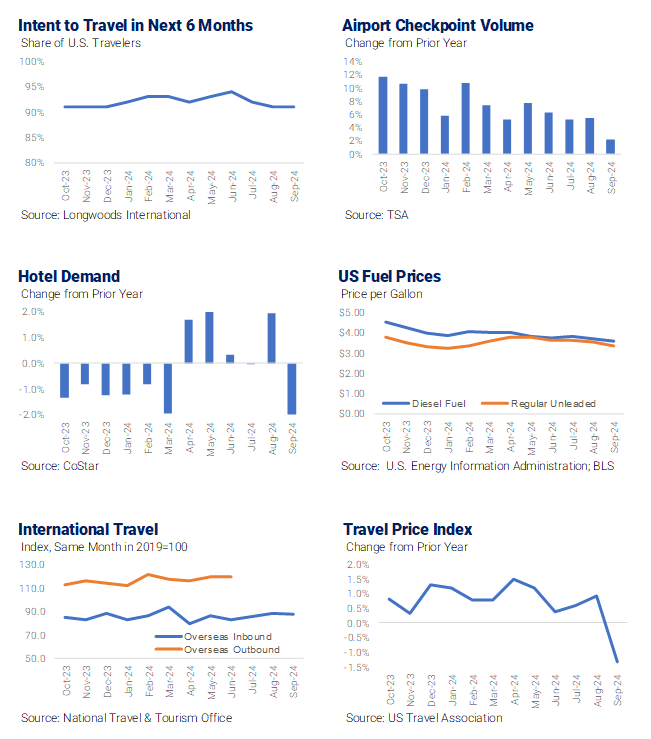

Hotel demand in the U.S. declined 2% in September compared to the same month last year, the worst performance since a similar 2% decline in March. September’s decline left third-quarter demand flat against the same period last year. Similarly, demand for the year to date through September was also unchanged versus last year.

Calendar shifts may have played a part in September’s weak demand. There were four Friday-Saturday night pairs in September 2024 versus five weekends in September 2023. The loss of the fifth weekend likely reduced leisure travel during the month and contributed to the drop in demand. On the other hand, this October has one less Sunday and Monday than a year ago. Sunday and Monday are typically weaker performing nights, and having fewer in a month should positively impact hotel results.

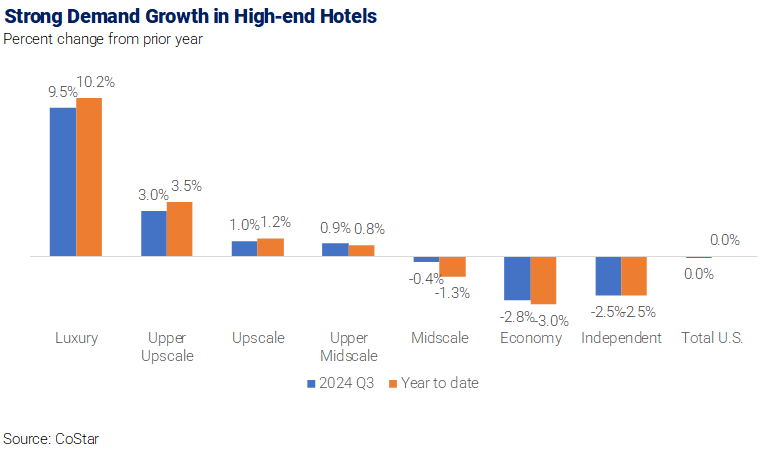

Third-quarter demand mirrored trends seen throughout the year. Demand continued to be weakest in the Economy and Midscale classes due to the impacts of inflation and higher interest rates on some household budgets. Conversely, demand remains strong in Upper-Upscale and Luxury hotels thanks to growth in business travel, conventions, and travel by upper-income households.

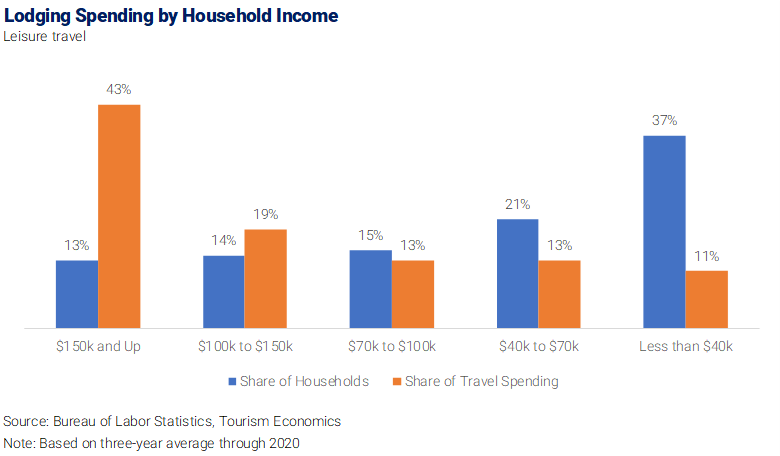

The resilience of demand in higher-end hotels aligns with the disproportionate share of hotel spending accounted for by higher-income households. Households earning more than $100k per year account for less than 30% of all households but more than 60% of hotel spending.

The inflation shock of the past few years weighed far more heavily on lower-income Americans. Even though nominal wage growth was strongest for low- and moderate-income households, the rising cost of essentials, which account for a larger share of their budgets, hit disproportionately harder. In particular, the large rise in rental costs and food prices hit budgets of low-income households far more than richer households.

Low-income households had a much smaller buffer to fall back on once excess savings left over from the pandemic ran out because they did not benefit as much from the gains in equity and house prices, and credit became much harder to get as interest rates rose.

The period of solid labor market conditions, steady growth in real disposable incomes, and declining interest rates that we expect over coming years will benefit households at all income levels and support solid growth in consumer spending. Slower inflation and lower interest rates will be particularly welcomed by lower-income households, and we anticipate demand among Economy and Midscale hotels will start to recover in the second half of 2025.

The Monthly Economy & Travel Industry Summary partners with Tourism Economics, an Oxford Economics company. Combining rigorous economic analysis with decades of travel industry expertise, Tourism Economics is an industry-leading insight resource. Learn more at www.tourismeconomics.com.